Shortly after 12.30 this afternoon Rishi Sunak, Chancellor of the Exchequer, delivered his second budget to parliament.

The Chancellor’s delivery of the budget to the House of Commons is largely ‘theatre’ with the real details being published in The Red Book by HM Treasury whilst the Chancellor speaks.

Whilst the presentation of the budget was concluded in a very swift 56 minutes, The Red Book promises many hours of reading and examination, however, our initial thoughts are that following the largest drop in annual national output for 312 years (the Great Frost of 1709 still takes some beating) the budget was a rather subdued affair.

The Chancellor described his budget as a three stage economic recovery plan to see the UK through the continuing COVID crises and beyond. The three stages are:

- Continued “crisis” support.

- Start the process of “fixing the public finances” and

- “Begin the work of building our future economy”

We’re providing this commentary as a snapshot of our current understanding, over the coming weeks, as The Red Book is scrutinised, our understanding will develop, but in any event, implementation of the budget is subject to the passing of the Finance Act. The Finance Act is usually debated in parliament after the Easter recess and presented to The Queen for Royal Assent before parliament’s summer recess.

Our snapshot of the budget, based on our current understanding (which will be subject to clarification and correction) is:

Personal taxes and pensions

• Income tax personal allowance to rise to £12,570 and higher rate tax threshold to £50,270 in 2021/2022 and then remain unchanged from 2022 until April 2026.

• NIC thresholds to rise in 2021/2022 (Primary threshold to £9568, Upper Earnings Limit to £50,270) and then remain unchanged until April 2026.

• CGT annual exempt amount to remain unchanged at £12,300 until April 2026.

• IHT nil-rate band and residence nil-rate band to remain unchanged at £325,000 and £175,000 until April 2026.

• Pensions lifetime allowance to remain unchanged at £1,073,100 until April 2026.

• ISA and JISA subscription limits to remain unchanged in 2021/2022.

• National Living Wage to increase to £8.91 an hour from April.

Corporate taxes

• Corporation tax to rise to 25% in April 2023 on profits over £250,000.

o Corporation tax will remain at 19% for businesses with profits of £50,000 with a taper on profits between £50,000 and £250,000.

• From 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery will get a 130% first-year capital allowance (super deduction).

• VAT threshold to remain unchanged at £85,000 until April 2024.

Housing

• Mortgage guarantee scheme to be launched in April 2021 which will provide a guarantee to lenders offering mortgages to people with a deposit of just 5% on homes with a value of up to £600,000. The scheme will run until the end of 2022.

• Temporary Stamp Duty cut to be extended until 30 June 2021. From 1 July 2021, the Nil Rate Band will reduce from £500,000 to £250,000 until 30 September 2021 before returning to £125,000.

Coronavirus Support

• Job Retention Scheme extended until end of September 2021.

Employees will continue to receive 80% of their wages and employers to contribute 10% in July and 20% in August and September.

• Self-employed support scheme extended until September 2021.

Access to be given to self-employed who have filed a tax return by 2 March 2021.

February to April grant to be worth 80% of three months’ average trading profits and capped at £7,500 in total.

May to September grant to be more focused with value of grant to be determined by a turnover test.

• Universal Credit £20 uplift extended until end of September 2021.

• One-off payment of £500 to be made to eligible Working Tax Credit claimants.

• Recovery Loan Scheme to be launched from 6 April 2021 to provide lenders with a guarantee of 80% on eligible loans between £25,000 and £10 million. Scheme will be open to all businesses, including those who have already received support under existing coronavirus loan schemes.

• Restart Grants to be made available in England of up to £6000 per premises for non-essential retail businesses and £18,000 per premises for hospitality, accommodation, leisure, personal care and gym businesses.

• VAT Deferral New Payment Scheme will allow any business that took advantage of the original VAT deferral in 2020 to pay deferred VAT in up to eleven equal payments from March 2021.

• Business rates reliefs to continue for eligible retail, hospitality and leisure properties in England. 100% relief from 1 April 2021 to 30 June 2021. 66% relief from 1 July 2021 to 31 March 2022.

Excise duties

• No increase to alcohol or fuel duties.

Environment

• Sovereign green bond (green gilt) to be issued this summer with further issues later in the years. Minimum value of issue will be £15 billion.

• Green retail NS&I product to be made available in the summer of 2021. This product will be closely linked to the sovereign green bond.

Infrastructure

• UK Infrastructure Bank to be established in Leeds and provide financial support to private sector and local authority infrastructure projects across the UK which help meet government objectives on climate change and regional economic growth.

• Freeports to be established at East Midlands Airport, Felixstowe & Harwich, Humber, Liverpool City Region, Plymouth and South Devon, Solent, Teesside and Thames.

The Chancellor of the Exchequer also shared the key economic forecasts, prepared by the independent Office of Budget Responsibility (OBR):

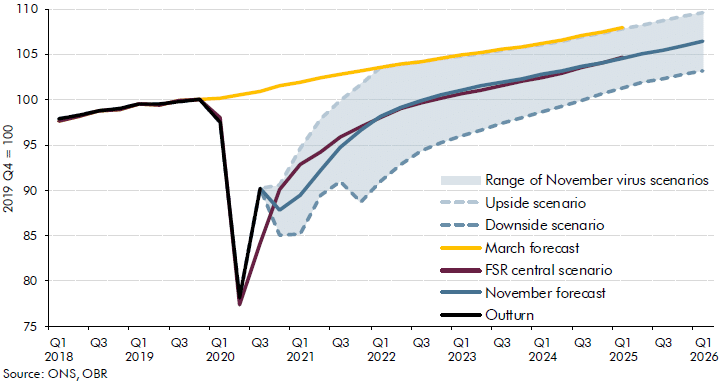

The OBR expects the size of the economy to be back at the pre-pandemic level in mid-2022 but that it will be 3% smaller in five years’ time than it would have been if the pandemic had not happened

Growth

2021: 4.0%

2022: 7.3%

2023: 1.7%

2024: 1.6%

2025: 1.7%

CPI Inflation

2021: 1.5%

2022: 1.8%

2023: 1.9%

2024: 1.9%

2025: 2.0%

Borrowing forecast (not expressed in cash terms)

2021/2022: 10.3%

2022/2023: 4.5%

2023/2024: 3.5%

2024/2025: 2.9%

2025/2026: 2.8%

Unemployment to peak at 6.8% in 2022 – 1.8 million fewer people expected to be unemployed than previously forecast.

We hope this snapshot is helpful and reiterate the provisional nature of this data.